hawaii capital gains tax rate 2021

The rate would be adjusted for inflation beginning in July 2022. Capital gains are currently taxed at a rate of 725.

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Nine states charge a lower long-term capital gains tax rate however similar to the federal government.

. Here are the details on capital gains rates for the 2021 and 2022 tax years. Inheritance and Estate Tax and Inheritance and Estate Tax Exemption. Place an X if tax from Forms N-2 N-103 N-152 N-168 N-312 N-338.

In Washington the tax rate proposed is equal to the rate in Seattle. Currently the maximum capital gains rate is 20. A capital gain rate of 15 will apply should your taxable income be at least 80000 but less than 441450 for single filers 496600 for married filing jointly or qualifying widower 469050 if you plan to file as head of.

Ordinary dividends are taxed at the same rate as the shareholders other income and rates range from 10 to 37. The highest rate reaches 725. In addition to the federal estate tax with a top rate of 40 percent some states levy an additional estate or inheritance tax.

New York Washington DC Minnesota Oregon New Jersey Hawaii and California. States have an additional capital gains tax rate between 29 and 133. Overview of Hawaii Taxes.

Exempted from the tax in Hawaii New York and Washington are 100 percent fruit juice unsweetened milk products dietary aids and infant. Here are the long-term capital gains tax brackets for 2020 and 2021. Arizona Arkansas Hawaii Montana New Mexico North Dakota South Carolina Vermont and Wisconsin.

Which allow taxpayers to have capital gains taxed at lower rates the state of California taxes capital. Impose estate taxes and six impose inheritance taxes. California has a flat corporate income tax rate of 8840 of gross income.

The tax rate shareholders pay on those dividends depend on whether the dividends are ordinary or qualified. And the sales tax rate is 725 to 1075. Proponents of maintaining a relatively low capital gains tax rate argue that lower rates make investing more.

Hawaii Income Tax Calculator 2021. Revenue is intended for public health spending. In Wisconsin the capital gains tax rates are listed as follows.

The rates listed below are for 2022 which are taxes youll file in 2023. Rates range from 140 to 1100. The long-term capital gains tax rate is usually 0 15 and 20 depending on your income and filing status.

Taxes capital gains as income and the rate reaches 853. The first capital gains tax was introduced along with the first federal income tax legislation in 1913. California Income Tax Calculator 2021.

Or Capital Gains Tax Worksheet on page 33 of the Instructions. On the next page you will be able to add more details like itemized deductions tax credits capital gains and more. Twelve states and Washington DC.

Generally only estates. Qualified dividends are taxed at lower capital gains tax rates ranging from 0 to 20. Most states have been moving away from estate or inheritance taxes or have raised their exemption levels as.

Luckily Hawaiians dont have to pay any local taxes. The federal corporate income tax by contrast has a marginal bracketed corporate income taxCalifornias maximum marginal corporate income tax rate is the 9th highest in the United States ranking directly below Maines 8930. Please remember that the income tax code is very complicated and while we can provide a good estimate of your Federal.

Indiana home sellers need to understand how these rate limits on capital gains taxes will affect their investment. Unlike the long-term capital gains tax rate there is no 0 percent rate or 20 percent ceiling for short-term. For example if you bought art in January 2021 and sold it in January 2031 which is after longer than 1 year you will have to pay long-term capital gains tax on any profits.

Maryland is the only state to impose both. A majority of US. 175 cents per ounce.

Long-term capital gains are the profits from the sale of assets that were held for longer than. And they follow the sellers income tax rate. The Washington income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022.

Residents of the beautiful volcanic islands of Hawaii are subject to a variable income tax system that features 12 tax brackets. Married Filing Jointly. Hawaii taxes capital gains at a lower rate than ordinary income.

2021 STATE OF HAWAII DEPARTMENT OF TAXATION Individual Income Tax Return RESIDENT Calendar Year 2021 OR AMENDED Return NOL Carryback. Capital gains tax rates have fallen in recent years after peaking in the 1970s. Our calculator can be used as a long-term capital gain.

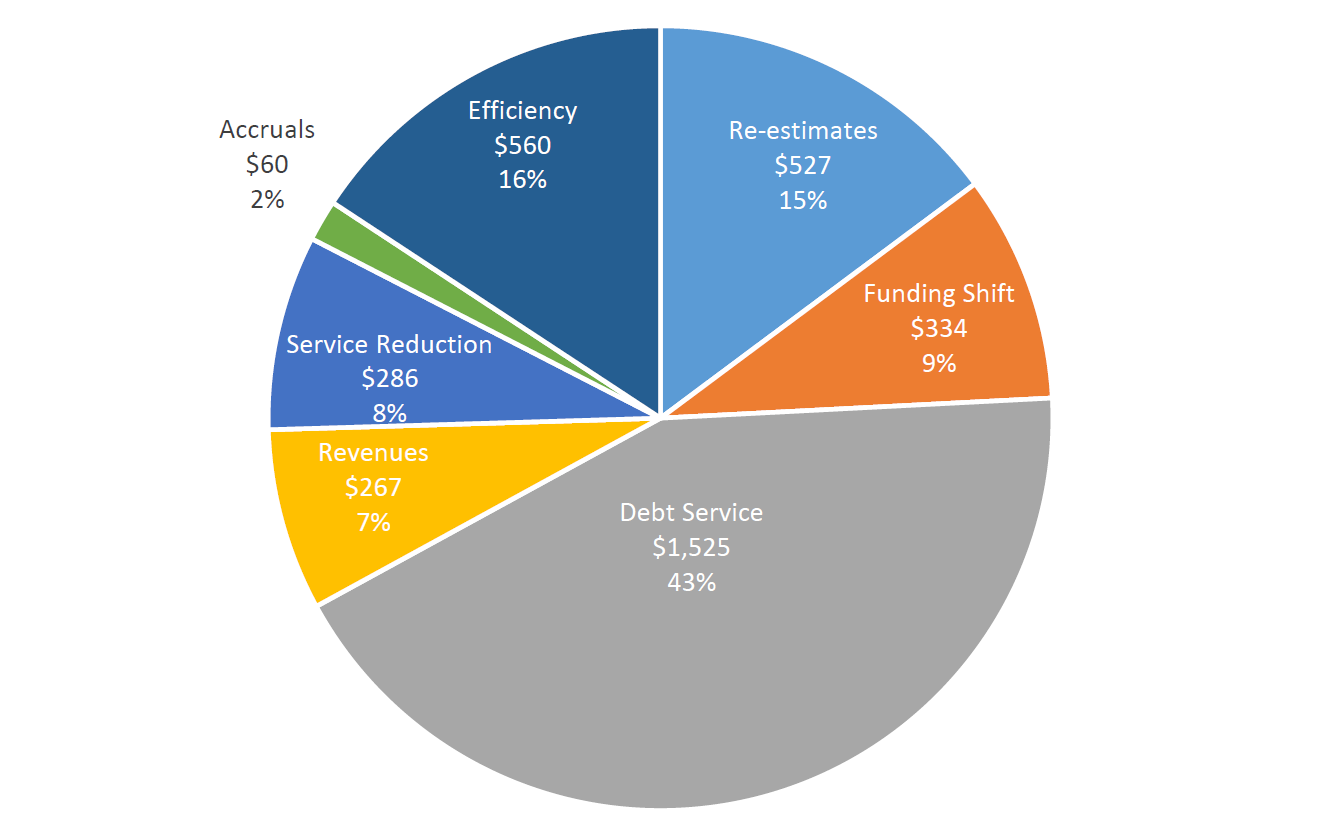

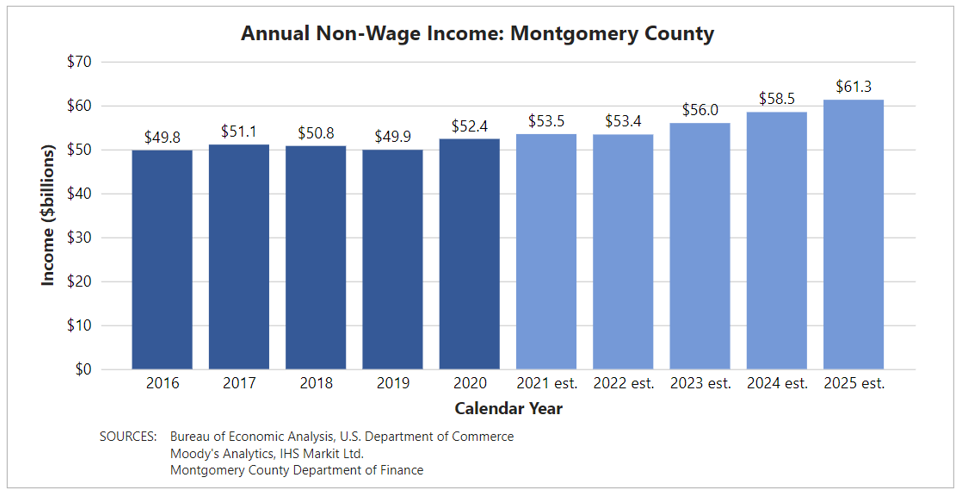

Revenues Montgomery County Maryland Operating Budget

State Taxes On Capital Gains Center On Budget And Policy Priorities

State Taxes On Capital Gains Center On Budget And Policy Priorities

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander

How Do State And Local Individual Income Taxes Work Tax Policy Center

Chapter Ii The West Virginia Economy John Chambers College Of Business And Economics West Virginia University

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

Do You Have To Pay Capital Gains Tax On Property Sold Out Of State

State Taxes On Capital Gains Center On Budget And Policy Priorities

Comments On New York City S Preliminary Budget For Fiscal Year 2022 And Financial Plan For Fiscal Years 2021 2025 Office Of The New York City Comptroller Brad Lander

Best Places To Live In Oregon In 2022 Bankrate

World S Best Performing Ipo In 2021 Korean Pharma Sk Bioscience Bloomberg

Revenues Montgomery County Maryland Operating Budget

2021 Financial Samurai Outlook For Stocks And Real Estate Financial Invest Wisely Real Estate